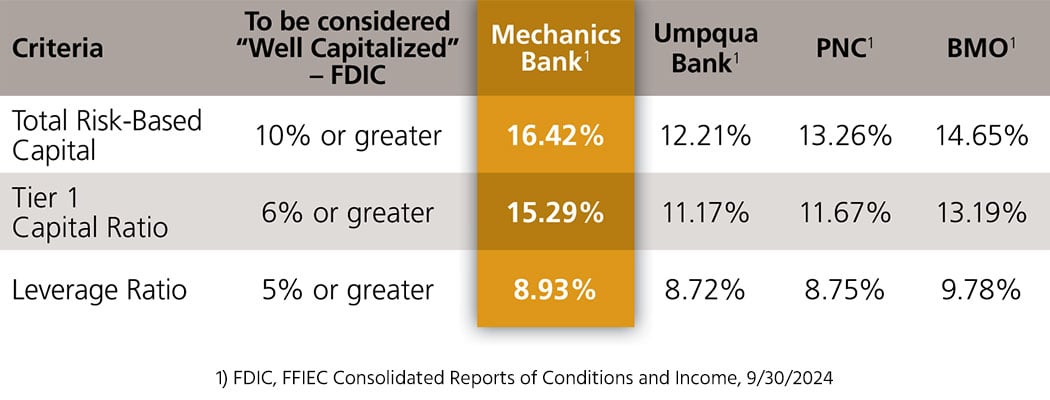

"Safety and soundness” is a term we’ve taken seriously and spoken of genuinely since 1905.

It points to the very foundation of the Mechanics Bank business model that puts safeguarding your money first. For some, business is strictly about profits and losses. For us, it’s about people and mutually beneficial relationships that endure. Understanding that every decision we make affects our clients, our employees and our shareholders, we know that, together, we’re stronger.

Managing a transparent and simple balance sheet free of hedges, derivatives or swaps, we value core banking and lending principles that have allowed us to withstand challenging times, including the 1906 San Francisco earthquake and fire, the Great Depression, and World Wars I and II. At the onset of the Great Recession in 2008, Mechanics Bank was among the first banks in the nation to turn down the Treasury Department’s “Troubled Asset Relief Program” (TARP) assistance.